Microhydro -Pre-Feasibility Case Study

A pre-feasibility study was undertaken into the potential of hydroelectricity generation at Lower House Farm near Dolau. The work considered two possible hydroelectricity schemes, a low head scheme on the site of a historical hydro-mechanical scheme adjacent to Lower House Farm and a high head scheme on land further away from the farm site.

By their nature the two schemes would be very different, a small low flow installation at the high head location and a larger higher flow scheme on the site next to the farm.

Site Overview

The map in Figure 1 shows the relationship between Lower House Farm and the stream in Penrochell Wood.

Figure 1: Map showing position of stream at Lower House Farm

Figure 2: High head scheme proposed location – blue shaded area (Courtesy Bing Maps).

The two schemes would be comparable in terms of budget costs. Although the Lower House Farm scheme has a shorter pipe length and is closer to the point of grid connection than the Penrochell Woods scheme (Figure 2), it would require a significantly larger intake and pipework to facilitate the volume of water required to rotate the larger turbine and generator.

The lower costs of the smaller component requirements of the Penrochell Woods scheme would also be offset by a longer pipe run and a significant and more challenging route to the point of grid connection.

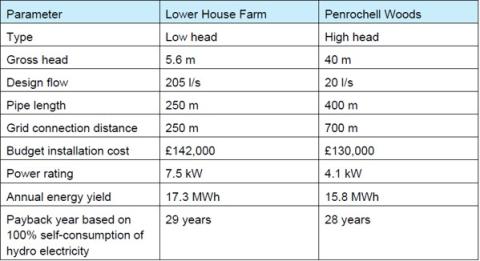

Energy outputs from both schemes would be similar and project payback times comparable as well (Table 1). However, it should be stressed that the payback periods have been calculated based on an assumption that all of the electricity produced from the schemes would be consumed on the farm site. If this were not the case, then the difference between the payback years of the two schemes could increase.

Table 1: Summary of hydro scheme parameters

Estimated savings and income for Low Head project

It has been assumed that the hydro scheme would be directly connected to either the farmhouse or the chicken shed. This would offset grid supplied electricity at a supply tariff rate of 25p/kWh. Three business models have been run using an assumption that 0%, 50% and 100% of hydroelectricity would be consumed by the farm over a 12 month period. The business models have been run over a 50 year period which could be expected to be the design life of the scheme.

It has been assumed that the balance of electricity would be exported to the grid, and this would generate revenue through the Smart Export Guarantee (SEG) at a rate of 5p/kWh.

For the purpose of the financial model, we have assumed that the cost of electricity would increase by 4.2% per annum which is the published average inflation rate between 1980 and 2020, and operational costs would increase in line with the Bank of England target rate of 2% per annum.

Financial Business Case

Table 2: Outputs from financial models

*The Internal Rate of Return (IRR) is a financial measure used to assess the attractiveness of a particular investment opportunity. The IRR for an investment estimates the rate of return of the investment after accounting for all projected cashflows together with the value of money over time. When selecting between several investments, the investor would normally select the investment with the highest IRR, provided it is above the investor's minimum threshold.

Conclusions and recommendations

There is technical potential for a 7.3kW hydro-electric scheme on Maes Brook near Lower House Farm. A suitable intake and powerhouse location have been identified and the power and energy calculations show that the energy generation would be in the order of 17.3MWh per annum.

The business models highlight the importance of consuming the hydroelectricity on the Lower House Farm site. If the project is to be progressed beyond this stage, then it will be important to accurately confirm how much of the hydroelectricity could be consumed on the farm using site consumption data for the farmhouse and the chicken shed. It should be recognised however that even with 100% self-consumption of hydroelectricity the project payback would likely payback in the 29th year of operation, unless the project installation costs could be reduced below those used in the financial model.

The next stages for development of the project would be as follows:

- Full feasibility study to more accurately determine the project costs and refine the business model

- Planning and abstraction licence applications

- Development of an Engineering, Procurement and Construction for tender purposes

- Tendering for suitable installation contractors

- Construction

- Operations and maintenance phase

Please contact timtechnegolcff@menterabusnes.co.uk if you would like to receive a copy of the full final report for this project.